Getting The Offshore Banking To Work

Table of ContentsThe Best Strategy To Use For Offshore BankingExamine This Report on Offshore BankingOffshore Banking Can Be Fun For EveryoneFacts About Offshore Banking UncoveredNot known Facts About Offshore BankingThe Facts About Offshore Banking UncoveredOffshore Banking Things To Know Before You Get ThisThe Offshore Banking DiariesNot known Details About Offshore Banking

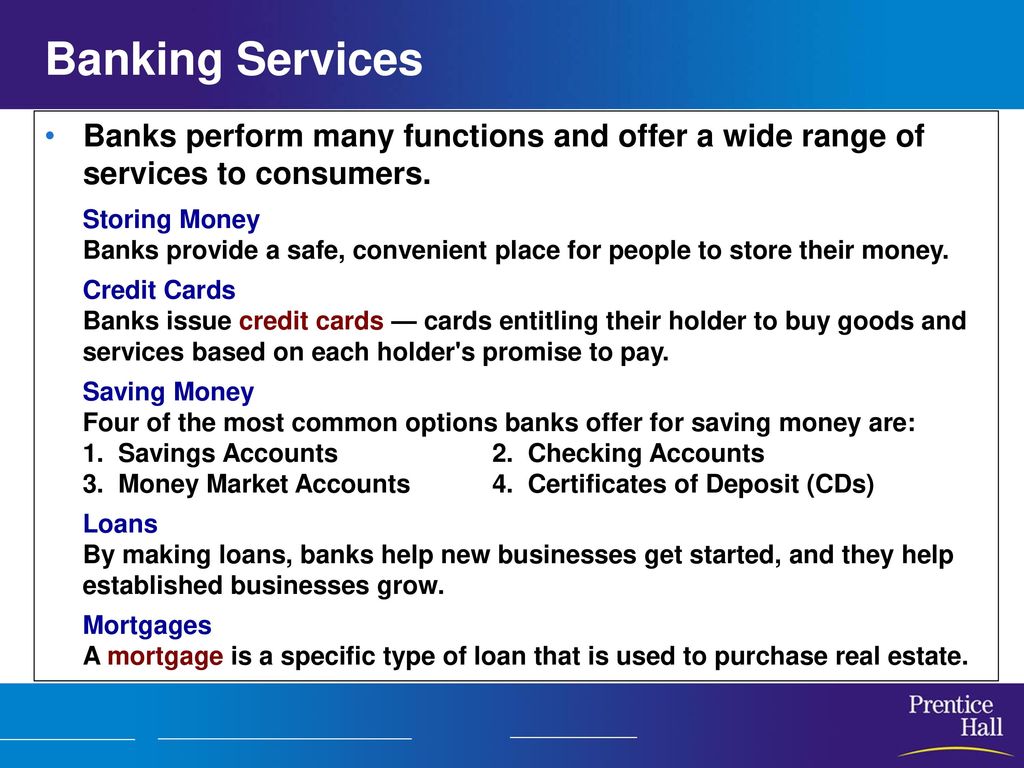

This procedure aids produce liquidity in the marketwhich produces money as well as maintains the supply going. Simply like any other business, the goal of a bank is to gain a revenue for its proprietors. For most financial institutions, the owners are their investors. Financial institutions do this by billing more rate of interest on the fundings as well as other financial debt they issue to consumers than what they pay to people who use their cost savings automobiles.

The Buzz on Offshore Banking

Banks make an earnings by billing even more interest to customers than they pay on interest-bearing accounts. A financial institution's dimension is determined by where it is situated as well as who it servesfrom little, community-based establishments to large business banks. According to the FDIC, there were simply over 4,200 FDIC-insured business banks in the USA since 2021.

Though conventional banks use both a brick-and-mortar area and also an on-line presence, a brand-new fad in online-only financial institutions emerged in the very early 2010s. These banks often provide customers higher rates of interest as well as lower fees. Ease, passion rates, and charges are a few of the aspects that help customers choose their chosen financial institutions.

The smart Trick of Offshore Banking That Nobody is Talking About

This website can assist you discover FDIC-insured financial institutions and branches. The mission of the Securities Investor Security Company (SIPC) is to recoup cash and also safeties in case a member brokerage company falls short. SIPC is a not-for-profit corporation that Congress produced in 1970. SIPC secures the clients of all signed up broker agent firms in the united state

What Does Offshore Banking Do?

You must take into consideration whether you intend to look what i found maintain both organization and also personal accounts at the same financial institution, or whether you want them at different financial institutions. A retail bank, which has standard financial services for clients, is the most suitable for day-to-day banking. You can pick a standard bank, which has a physical building, or an on the internet financial institution if you do not want or require to literally check out a bank branch.

, for example, takes deposits and also offers in your area, which might supply a much more customized financial connection. Pick a convenient location if you are selecting a bank with a brick-and-mortar location.

Offshore Banking for Dummies

Some financial institutions also offer smartphone apps, which can be helpful. Some big financial institutions are moving to end over-limit fees in 2022, so that can be an essential consideration.

After making some marginal reductions (in the form of compensation), the bank pays the bill's worth to the holder. When the bill of exchange grows, the financial institution obtains its settlement from the celebration, which had approved the bill.

What Does Offshore Banking Mean?

Financial institutions help their clients in moving funds from one place to an additional with cheques, drafts, and so on. A bank card is a card that allows its holders to make purchases of goods and services in exchange for the charge card's company instantly paying for the items or solution. The cardholder guarantees to pay back the purchase total up to the card supplier over time and with passion.

Mobile banking (also referred to as M-Banking) is a term utilized for executing try this site balance checks, account purchases, settlements, credit report applications, and various other banking deals via a mobile gadget such as a cellphone or Personal Digital Assistant (PERSONAL ORGANIZER), Accepting deposits from savers or account holders is the main function of a financial institution.

The Only Guide for Offshore Banking

Individuals favor to deposit their cost savings in a financial institution because by doing so, they earn interest. Top priority banking can include a number of various services, however some preferred ones include totally free monitoring, on the internet bill pay, financial assessment, and also details. Personalized financial as well as banking solutions are typically provided to a bank's digital, high-net-worth individuals (HNWIs).

Exclusive Financial institutions intend to match such people with one of the most appropriate alternatives. offshore banking.

About Offshore Banking

Not just are cash market accounts Federal Deposit Insurance Corporation-insured, but they make higher passion prices than inspecting accounts. Cash market accounts minimize the threat of investing due to the fact that you always have access to your money you can withdraw it any time scot-free, though there may some constraints on the variety of transactions you can make each month - offshore you can try this out banking.

Business financial typically offers greater revenues for banks because of the huge quantities of cash and interest included with company loans. Sometimes the 2 departments overlap in terms of their solutions, but the real difference is in the customers and also the revenues each banking kind gains.

Fascination About Offshore Banking

You desire to pick a financial institution that uses a full range of solutions so it supports your banking needs as your organization grows. ACH allows cash to be transferred electronically without making use of paper checks, cable transfers or money.